Planning Ahead: Insurance Agency Succession Planning Through Internal Perpetuation

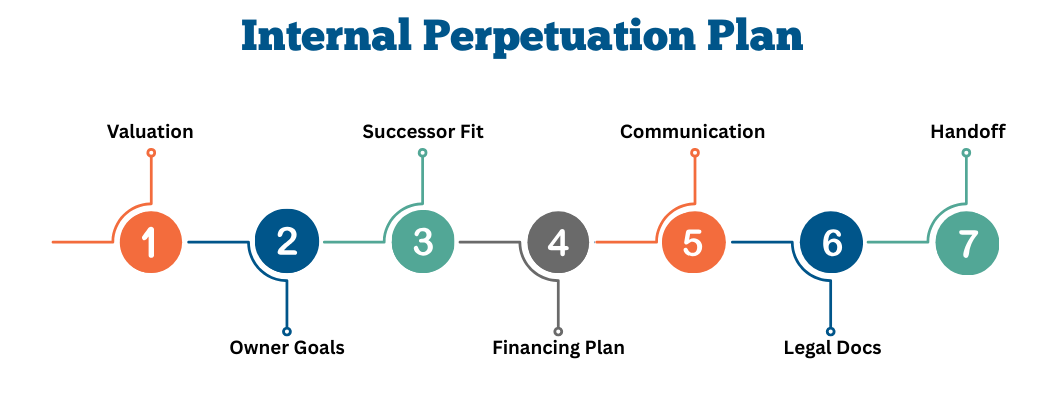

Successfully transitioning your agency to the next generation can be an incredibly rewarding experience—but it also comes with challenges. Whether you’re transferring ownership to family members or a trusted management team, effective insurance agency succession planning requires a well-structured approach. From valuations to financing and timelines, insurance agency perpetuation planning is about far more than just naming a successor.

Unfortunately, according to the SBA, only 30% of small businesses successfully transition to a second generation—and that number drops to 12% by the third. Those odds can improve dramatically with the right strategy and support.

At INS Capital Group, our team has overseen hundreds of internal agency transitions, helping insurance agency owners develop succession plans that work—for them and for their internal successors.

Four Common Challenges for an Internal Perpetuation

1. Valuation Missteps in Internal Agency Transitions

The Problem: Agency owners often miscalculate the value of their business, using external sale benchmarks or internet headlines that reflect strategic buyer valuations—not internal deal realities.

The Solution: INS Capital Group offers a Strategic Market Analysis—a valuation designed specifically for insurance agency perpetuation planning. This approach provides both the internal value (what a management team or family member might pay) and the strategic external value (what a competitor or PE-backed buyer might offer). With this insight, owners can craft a fair purchase price and deal structure that supports a smooth internal agency transition.

2. Unclear Timelines Undermine Succession

The Problem: Even when owners express a desire to hand off the agency, they often avoid setting a concrete timeline. Delays create confusion and anxiety among future leaders.

The Solution: Once valuation expectations are realistic, owners can confidently define a transition timeline. One of the strengths of insurance agency succession planning is its flexibility: some sellers want to exit entirely at a fixed date, while others prefer to phase out over time. With support from INS Capital Group, we help tailor the plan to your lifestyle and leadership goals.

3. Late-Stage Financial Conversations Create Roadblocks

The Problem: One of the most common failures in insurance agency perpetuation planning is waiting too long to discuss deal terms with internal successors. In many cases, management teams aren't prepared—or willing—to take on the necessary debt.

The Solution: Open the conversation early. Once the price and structure are defined, owners should walk potential buyers through the numbers, including purchase terms, seller financing, and business performance. INS Capital works with both parties to refine the deal so it meets the needs of everyone involved, avoiding last-minute surprises that could jeopardize the entire transition.

4. Choosing the Wrong Lender for Internal Buyers

The Problem: You’ve agreed on deal terms—but the financing falls apart. Some lenders might only offer partial funding, pushing risk back onto the seller.

The Solution: Our team has deep lending experience in the insurance space. In fact, many of the lending programs used by top insurance banks today were developed by our experts. We help match internal buyers with lenders that specialize in agency succession financing—ensuring a structure that supports long-term success.

Think of it this way: just as agents match clients with the right insurer, INS Capital matches agencies with the right financing partner to complete a successful internal agency transition.

Beat the Odds with Expert Succession Support

If you're considering keeping your business in the family—or handing it off to trusted leaders within—know that successful insurance agency succession planning is possible. INS Capital Group helps agency owners avoid the common missteps that cause most internal perpetuation plans to fail.

From valuation to financing to timeline design, we tailor every step to your vision.

Ready to develop your agency’s internal succession strategy?

Reach out to us at info@inscapitalgroup.com.

INS Capital Group offers comprehensive insurance agency perpetuation planning, succession strategies, buy-side and sell-side advisory, and valuation services. Our team has closed over 1,500 insurance agency transactions representing more than $5 billion in value.